Cautious Opening at Borsa Istanbul: Here’s the Latest Lira Situation

Borsa İstanbul Started the Day Calmly

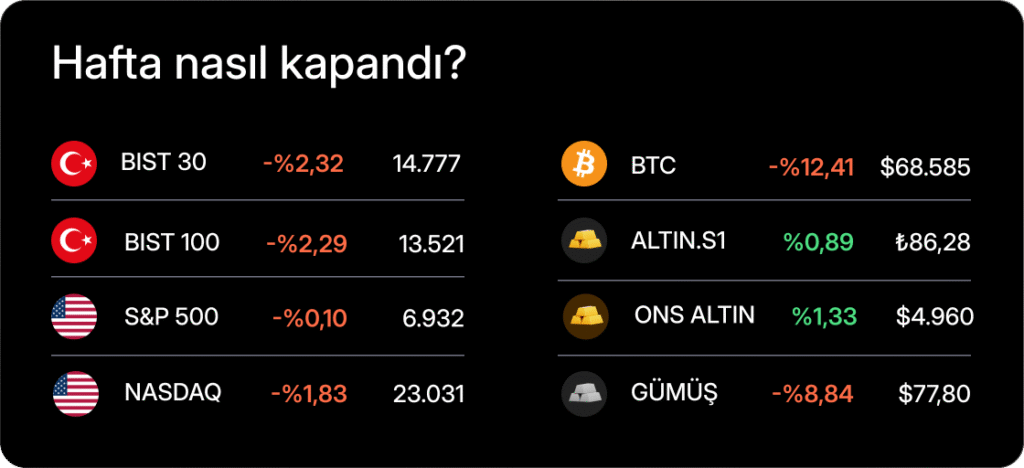

As expectations for interest rate cuts in the US continue to rise in global markets, investor caution is creating a mixed outlook in Borsa İstanbul. The BIST 100 index, which gained approximately 2 percent at the beginning of the week due to a strong buying wave, was able to maintain a positive trend on Tuesday but could not sustain this momentum.

Fluctuating Trend and Selling Pressure

On Wednesday, the index pulled back by 0.78 percent due to increasing selling pressure, and on Thursday, it fell 1.07 percent, dropping below the critical 11,000 points threshold. Analysts evaluate this negative trend, which investors are closely monitoring, in light of market dynamics and international developments.

BIST 100 Index and Sector Performances

Today, the BIST 100 index reached 10,923.58 points with a modest increase at the opening, showing an increase of 5.06 points (0.05 percent) compared to the previous close. The banking index saw a decrease of 0.12 percent, while the holding index rose by 0.18 percent. Among sector indices, the mining sector experienced the highest increase, rising by 1.64 percent. On the other hand, the sector that declined the most was financial leasing and factoring, which lost 0.70 percent.

Market Observations and Expectations

Analysts indicate that during the day, both the domestic treasury cash balance and, abroad, growth data from the Eurozone, as well as personal consumption expenditures and the University of Michigan's consumer sentiment index from the US will be monitored. Technically, the support levels for the BIST 100 index are noted as 10,900 and 10,800, while the resistance levels are highlighted as 11,000 and 11,100 points.

Benzer Haberler

.png)

Yakında Tüm Platformlarda

Sizlere kesintisiz haber ve analizi en hızlı şekilde ulaştırmak için. Yakında tüm platformlarda...

.png)