Year-End Market Analysis: What Will Happen?

Market Uncertainties and Holiday Calendar

As the last trading day of the year approaches, the holiday calendar plays an important role in global markets. While many markets in Europe will be closed, trading will conclude early in the UK, France, and Spain. Although US markets will remain open, it is expected that the bond market will have a half-day of trading. This situation highlights how the holiday effect will shape the market.

US Markets' Status

US indices are preparing to close 2025 with an approximately 17% increase. Due to the impact of artificial intelligence and fiscal incentives, positive expectations for 2026 continue. However, high valuations and geopolitical risks may hinder the acceleration of the year-end rally. According to the latest FOMC minutes, the likelihood of a rate cut at the Fed's January meeting appears low, but it is believed that additional cuts could occur in line with the decline in inflation.

Opinions on Commodities and Local Markets

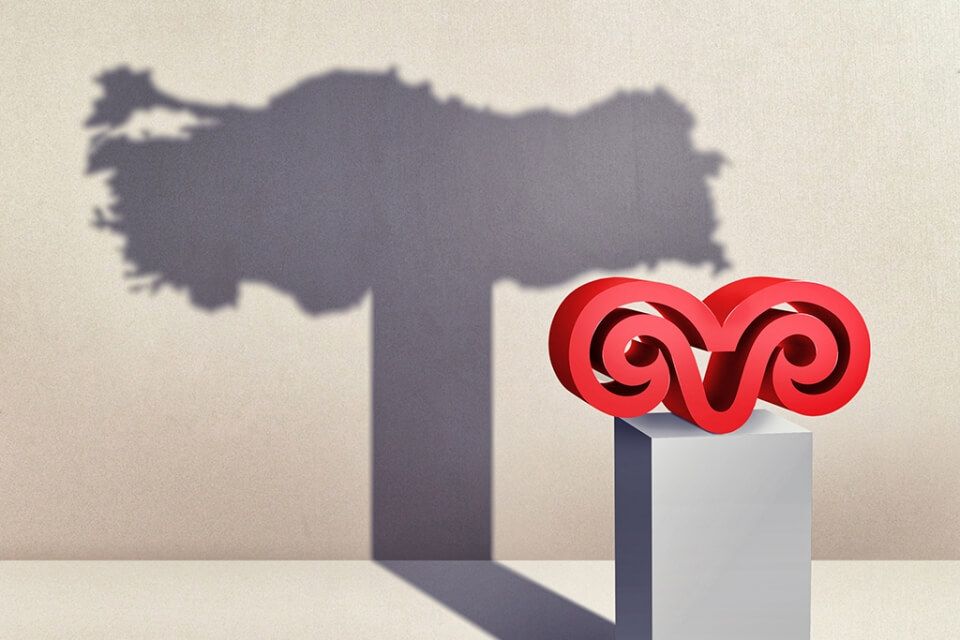

Profit-taking is noteworthy in precious metals, which have performed strongly throughout the year. While declines are observed in gold and silver, Brent crude oil is moving sideways. It is expected that concerns about excess supply at the OPEC+ meeting will limit production increases. In Turkey, it is anticipated that market movements will remain within a narrow band due to year-end effects. The BIST 100 index has shown recovery efforts after recently falling below the 11,300 level.

Banking Sector and Bond Markets

While the banking index is experiencing a volatile trend, benchmark bond yields have decreased alongside the TCMB's interest rate cut process. The upward trend in the dollar/TL continues. With gradual increases, the 43.00 level has gained importance as a psychological threshold. It is expected that overall trading volume will be limited on the last trading day of the year.

Conclusion and Expectations

It is anticipated that inflation data to be released on Monday and monetary policy steps will have a more significant impact on market pricing starting in January. Details regarding stocks with strong technical appearances continue to attract investors' interest.

It should be noted that the information shared here does not constitute investment advice.

Benzer Haberler

.png)

Yakında Tüm Platformlarda

Sizlere kesintisiz haber ve analizi en hızlı şekilde ulaştırmak için. Yakında tüm platformlarda...

.png)