Key Points to Consider in Option Transactions

What is a Warrant?

A warrant is a financial instrument traded on the stock exchange that allows the investor to evaluate their expectations regarding the price movements of a specific underlying asset (such as an index, stock, or currency). For example, if you believe that the BIST 30 index will rise, you can purchase a call warrant in anticipation of the upward movement. Conversely, if you expect a decline, you may prefer to buy a put warrant. If the market moves in the direction you anticipated, the warrant price increases rapidly due to the leverage effect.

Factors to Consider When Choosing Warrants

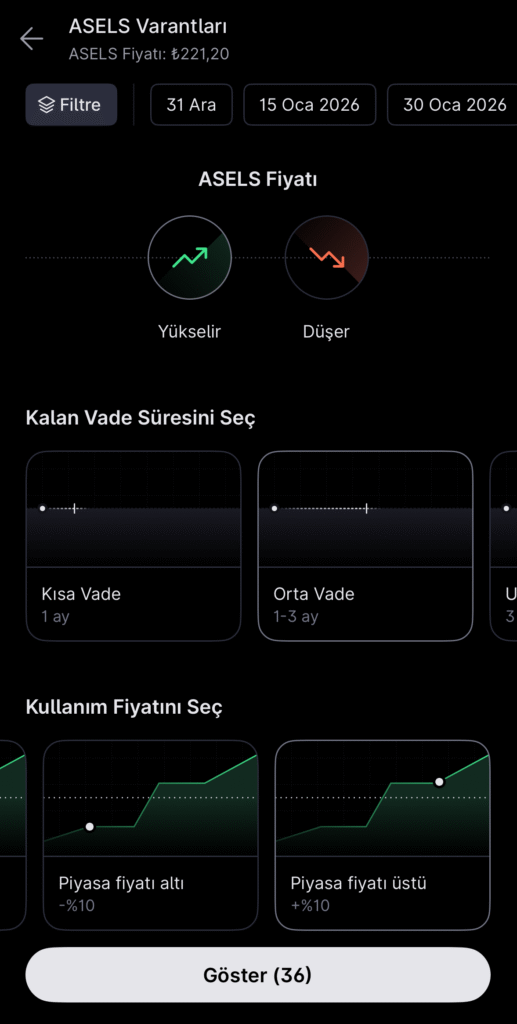

To be successful in purchasing warrants, making the right selection is crucial. In this regard, filter screens are your most important tool. Filter screens list suitable warrants according to the direction (upward or downward) and the expiration expectations set by the investor, making it easier to choose. First, you should determine the direction based on your investment expectations, and then proceed with selecting the appropriate expiration and exercise price.

Warrant Analysis and Parameters

Key parameters to consider when buying warrants include delta, theta, gamma, and vega. Here are the functions of these parameters:

- Delta: Indicates the directional sensitivity of the warrant. Call warrants have a value between 0 and +1, while put warrants have a value between 0 and -1. When the delta value is around 0.5, the warrant is at its breakeven point.

- Effective Leverage: Indicates the effect of a 1% change in the underlying asset on the warrant. When this value is high, the potential for profit increases, but the risk of loss also grows.

- Theta: Shows how much the value of the warrant will decrease as the expiration date approaches. This is considered a negative effect because, over time, the value of the warrant declines.

- Vega: Measures sensitivity to changes in volatility. When volatility increases, warrant prices also rise.

Market Maker Spread

The difference between the buying and selling price of a warrant is called the market maker spread. The narrower this spread, the higher the liquidity of the warrant. An ideal spread range for healthy trading of a warrant is between 5-10%.

It should be remembered: Careful analysis and consideration of market conditions in the purchase of warrants will help reduce potential risks.

```Benzer Haberler

.png)

Yakında Tüm Platformlarda

Sizlere kesintisiz haber ve analizi en hızlı şekilde ulaştırmak için. Yakında tüm platformlarda...

.png)