Clean energy incentives to stake: First Solar and Nextracker stand out

📌 What Happened?

Wells Fargo has signed off on a critical review that closely concerns the clean energy sector. The bank analyzed the effects on solar stocks of the possible elimination of tax incentives provided under the Inflation Reduction Act (IRA) in the United States. The bank stated that even in this scenario, there may be an opportunity to buy some shares, and made remarkable conclusions for investors.🌍 Spherical Axis

The prospect of a U.S. retreat on clean energy policies is a cause for concern not only for domestic but also for global markets. Faced with growing competition from Europe and China, the potential loss of stimulus to the American renewable energy sector could create new balances in the global supply chain. Especially in the context of US-China trade tensions, developments in favor of companies such as First Solar can be expected.🎯 Note to Investor

The complete elimination of tax incentives could lead to serious corrections in solar stocks, according to Wells Fargo's analysis. But long-term opportunities can arise in structurally strong companies. Therefore, it is recommended that investors turn to firms with high resilience to incentives when diversifying their portfolios.🔍 Risk & Opportunity Summary

Opportunities:• Structural advantages in companies with strong supply chains such as First Solar and Nextracker • Potential to be positively impacted by new tariffs and FEOC regulations • New regulatory possibilities where U.S. domestic production will be prioritized Risks:

• Demand reduction of up to 70% in case of sudden abolition of tax incentives • High vulnerability in companies such as SolarEdge, Canadian Solar and Sunrun • Uncertainty in US policies and new surprises in the budget process

📢 Expert Review

“Although the scenario of abolishing tax incentives creates pressure in the short term, it could pave the way for structural upside for companies with high production power and domestic footprints.”✅ Take Action

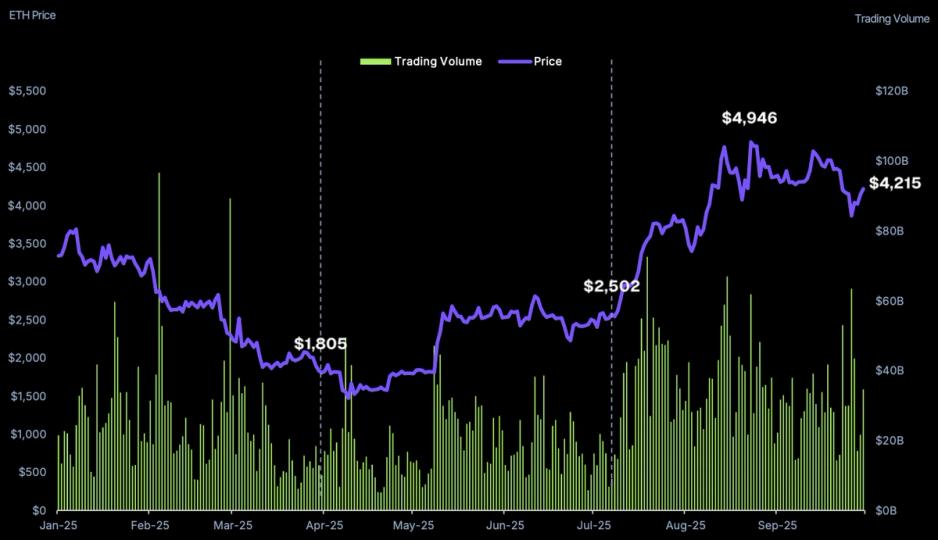

Track BTC price liveExplore crypto analytics

🛑 Disclaimer

This content is not investment advice. You should make your decisions based on your own research and professional advisors.

investment desk, analysis, stock, stock exchange, balance sheet, crypto, US markets, BIST 100, technology stocks, Trump, Wells Fargo, First Solar, Nextracker, solar power, tax incentives, Inflation Reduction Act, clean energy, US budget, solar stocks, 45X credit, FEOC regulation, Sunrun, SolarEdge, Canadian Solar, IRA incentives, ITC, US-China tension, energy policy, manufacturing incentives, domestic production, portfolio diversification, renewables, solar stocks, tax credits, First Solar shares, Wells Fargo analysis, clean energy, US budget 2025, solar incentives, IRA repeal, energy market, ESG investing, Biden energy policy, solar sector outlook, domestic production, utility-scale solar

Benzer Haberler

.png)

Yakında Tüm Platformlarda

Sizlere kesintisiz haber ve analizi en hızlı şekilde ulaştırmak için. Yakında tüm platformlarda...

.png)