What You Need to Know Before the Market Opens: Tips for January 15

What You Need to Know Before the Market Opens

The current situation in global markets is shaped by geopolitical developments and the policies of central banks. Donald Trump's statements on Iran, Venezuela, and Greenland have significant effects on the markets, while investors prefer to approach these situations cautiously. It is observed that the 'wait-and-see' strategy developed against tariff decisions influences investor behavior and keeps risk appetite balanced.

The Effects of Economic Data and Fed Policy

The latest data regarding the US economy shows a slow weakening in employment and stability in inflation. This situation allows the Fed to maintain its dovish stance, while interest rate cut expectations seem to lead to only limited fluctuations. Comments from Fed members indicate that the inflation risk has not completely disappeared, but a sudden tightening is unnecessary.

The Situation in Risky Assets and Commodities Markets

While pricing in risky assets continues within a narrow band, it is observed that the main reactions are concentrated in commodities. Precious metals like gold continue to remain strong due to geopolitical uncertainties and questions regarding monetary policy. Although oil prices retreated after a softening in Trump's statements, it is noteworthy that the geopolitical risk premium still exists.

Observations on BIST 100 and the Banking Index

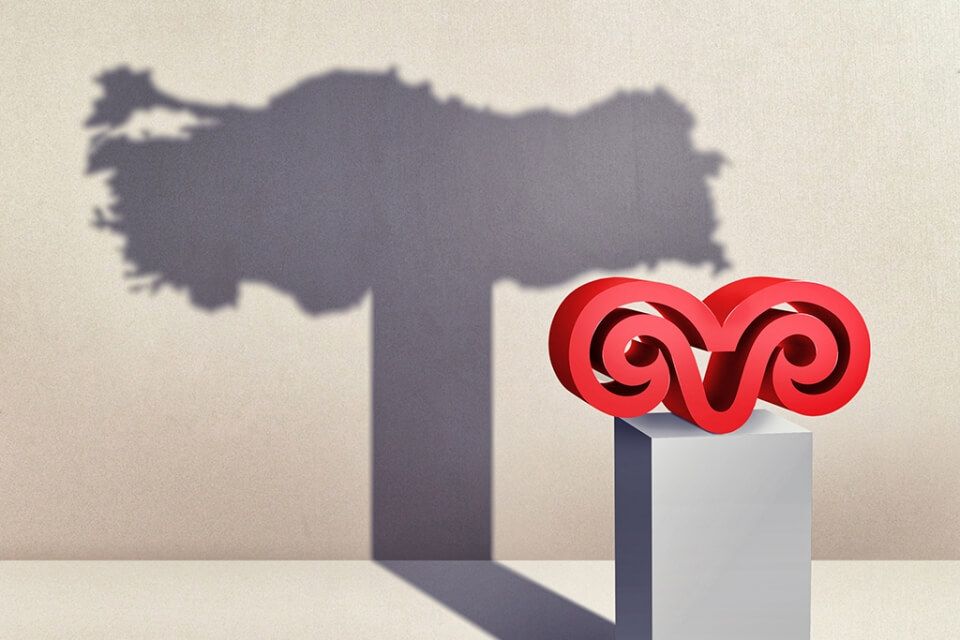

The BIST 100 index continues to stay above 12,000, with new record attempts being made following the break of the 12,400 resistance. Even during moments of intraday profit-taking, stabilization can be seen at lower support levels, indicating that the upward trend continues. In the banking index, however, a more stable course is observed following the high rises seen in previous periods.

Developments in the Bond and Currency Markets

In the bond market, a limited increase has been observed in recent days, but the overall outlook continues to be supported by the disinflation process. The strengthening of the dollar/TL above the 43.00 level draws attention, while the euro/dollar pair is still trying to stabilize in the 1.1650–1.16 band.

Expectations for the Coming Days

Important agenda items in the domestic market include the TCMB's interest rate decision, evaluations of Turkey by credit rating agencies, and budget data. Additionally, it is anticipated that political and geopolitical developments may create fluctuations in the markets. Furthermore, the recent limited realizations could be seen as signs of healthy corrections.

Technical Analysis

It is recommended to monitor stocks with a strong outlook. Movements observed alongside profit realizations carry signs that indicate the market trend is healthy. Close observation of the index and banking situation is essential for future investment decisions.

```Benzer Haberler

.png)

Yakında Tüm Platformlarda

Sizlere kesintisiz haber ve analizi en hızlı şekilde ulaştırmak için. Yakında tüm platformlarda...

.png)