Critical Developments You Need to Know Before the Market Opens

Market Analysis and Important Developments

Geopolitical risks and the decisions made by central banks continue to have an impact on global markets. The U.S. seizure of a Venezuela-linked oil tanker, combined with uncertainty in the Middle East, has increased investors' search for safe havens. This situation has led to a rise in oil prices, with Brent crude surpassing the $60 level and WTI testing the $57 band.

Increase in Precious Metals

Under a similar risk perception, precious metals have also gained value. In the Asian session, gold reached nearly $4,500 per ounce, hitting new record levels, while silver started to challenge the $70 threshold. This situation has increased investors' interest in precious metals.

U.S. Economy and Growth Data

Last week, inflation data released from the U.S. fell below expectations, while strong financial results from major tech companies bolstered risk appetite. U.S. indices, which started the week positively, particularly highlighted industrial, financial, raw material, and energy stocks. However, the low trading volumes due to the holiday week have drawn attention. Today's release of third-quarter growth data, core PCE, and daily durable goods orders are closely monitored by investors.

Asian and European Markets

In Asia, the depreciation of the Japanese yen stands out. Japanese officials have reacted to this decline in the yen's value, while the USD/JPY pair has dropped to the 156 level. European markets are following a calmer trend due to the Christmas week. The European Central Bank's (ECB) upward revisions of inflation and growth forecasts, as well as expectations for defense and infrastructure spending, remain significant in the medium term.

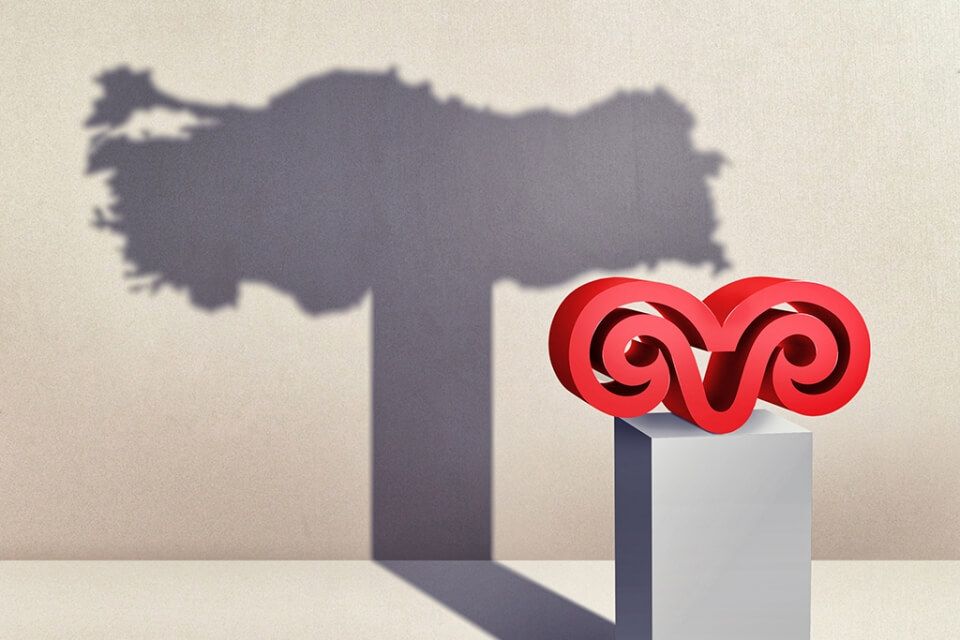

Domestic Market Developments

The BIST 100 index closed the first trading day of the week at 11,311 points with a limited loss. The trading volume, which reached 134 billion TL, was noteworthy. Financial leasing and factoring stocks saw strong increases, while brokerage firm stocks faced selling pressure. The banking index continued its upward trend. In the short term, market fluctuations around technical levels are expected, as there is no distinct flow of news.

```Benzer Haberler

.png)

Yakında Tüm Platformlarda

Sizlere kesintisiz haber ve analizi en hızlı şekilde ulaştırmak için. Yakında tüm platformlarda...

.png)