Ethereum Markets Rocked

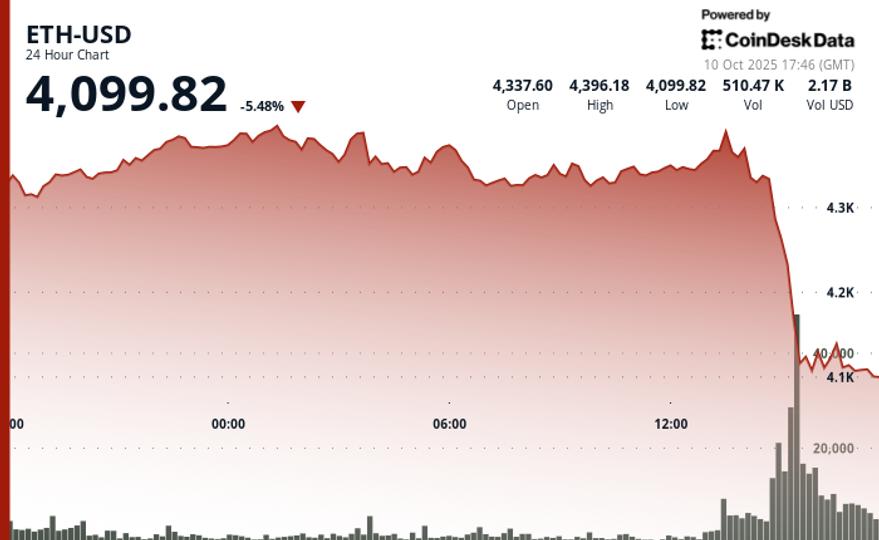

Ethereum experienced a significant decline in the cryptocurrency markets due to rising trade tensions between the U.S. and China. Donald Trump threatened to increase tariffs on Chinese goods, causing a loss in the value of cryptocurrencies. This situation led to a 7% drop in Ethereum's native token, ether (ETH), making it the most affected asset in the CoinDesk 20 Index.

As of Friday, ETH fell below $4,100, a price not seen since late September. This drop was particularly pronounced compared to Bitcoin (BTC), which saw a 3.5% loss, and the index's 5% decline. In the cryptocurrency derivatives market, it was observed that more than $600 million worth of leveraged positions were liquidated. According to CoinGlass data, ETH led these liquidations, resulting in more than $235 million worth of long positions being wiped out.

Technical Analysis and Support Level

The reason behind the liquidation wave was ETH breaking through significant support levels. The technical analysis model from CoinDesk Research highlighted the following details:

- Sell pressure manifested with a volume of 372,211 units at 14:00 UTC, nearly double the 24-hour average volume.

- Volume-based resistance was confirmed at the $4,287 level.

- Primary resistance was identified at $4,141 during a failed rebound attempt.

- Potential support where buyers may emerge is starting to form just below $4,100.

⚖️ Yasal Uyarı:Bu içerik yatırım tavsiyesi niteliği taşımaz. Yatırımlarınızla ilgili kararlarınızı kendi araştırmalarınız ve risk profilinize göre almanız önerilir.

Ethereum, cryptocurrency, liquidation, Donald Trump, trade tensions, Ether

.png)