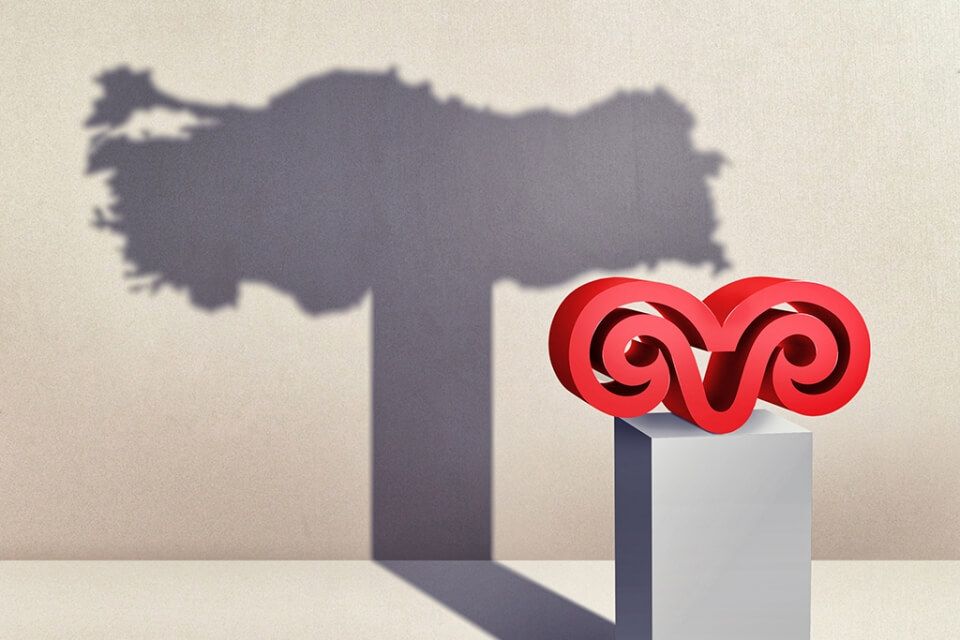

Essas Holding's Major Transformation Strategy for Pegasus Shares

Esas Holding's Critical Application

Esas Holding has signed an important transformation move regarding its subsidiary Pegasus Airlines Inc. (#PGSUS). The company applied to the Capital Markets Board (CMB) requesting that 10% of Pegasus's capital, totaling 50 million TL of nominal value of registered shares, be traded on Borsa Istanbul.

Application in Accordance with Legal Regulations

The application was stated to have been prepared within the scope of CMB's Communiqué VII-128.1 on Shares, and it was noted that this process is critical for financing. Esas Holding announced that it plans to use the specified shares as collateral in a three-year maturity loan financing.

Trading of Shares and Use of Collateral

The necessary procedures were carried out with the Capital Markets Board on December 26, 2025 for the approval of the “Share Sale Information Form” prepared within the scope of the application. This action was taken for the purpose of providing collateral to financial institutions. However, it was emphasized that this situation will not hinder the exercise of shareholders' rights by Esas Holding.

No Share Sales for Three Years

Esas Holding stated that, following the transformation operations, it has pledged that the shares expected to be traded will not be sold on or off the exchange for three years. This effort is part of the company's aim to maintain its financial health and market stability.

Thus, with the transformation of Pegasus shares, Esas Holding aims to secure financing conditions and elevate corporate governance standards. This strategy carries elements that will attract the attention of investors and market analysts.

Benzer Haberler

.png)

Yakında Tüm Platformlarda

Sizlere kesintisiz haber ve analizi en hızlı şekilde ulaştırmak için. Yakında tüm platformlarda...

.png)