5 Critical Investment Lessons Learned from 2025

5 Critical Investment Lessons Learned from 2025

The year 2025 was far from just a year to observe for investors. Political developments, customs tariffs, trade wars, and discussions surrounding artificial intelligence highlighted how complex the investment environment had become. In the uncertainties of 2025, the market managed to carve out its own path.

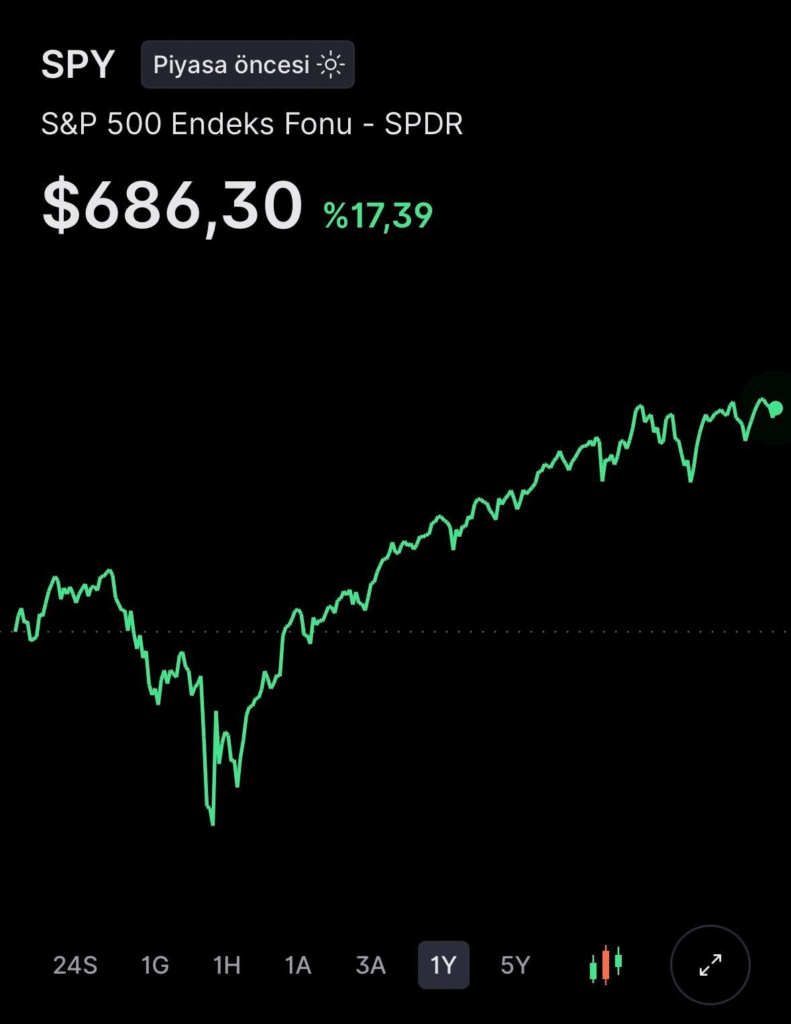

In the United States, after a brief and sharp shock, the market's ability to recover quickly became evident. Following peaks in February, there was a significant decline of 20% until April. However, this drop was not permanent, and throughout the year, the opportunity to reach many new peaks arose.

With the arrival of summer, strong balance sheets, continued investments in artificial intelligence, and an increasing risk appetite began to put various uncertainties behind us.

Lesson 1: Tough Times are Opportunities for Right Decisions

One of the most educational periods of 2025 was the tariff crisis between February and April. During this time, market turbulence affected investor psychology, leading many to turn to cash. However, 2025 showed us that tough moments can often be the times when the right decisions are made. The market began to rise rapidly amid uncertainties, and making hasty decisions during this process could lead to losses.

Lesson 2: Carrying a Winner is Difficult

2025 presented challenges in carrying returns from both artificial intelligence stocks and assets like gold. The fluctuations throughout the year often left investors pondering the question “Should I sell?” Winning assets were typically purchased before they garnered much attention, and being patient with the continuity of the rise became a critical trait.

Lesson 3: Balloon Fear Can Lead to Timing Errors

One of the concerns occupying investors' minds throughout 2025 was whether artificial intelligence constituted a bubble. High valuations led many investors to sell early. However, this situation made it difficult to make the right decisions on time.

Lesson 4: Sideways Markets Require Strategy

The sideways movement of BIST in 2025 revealed the losses faced by passive investors. To capture opportunities in a stagnant market, it is necessary to develop an active management strategy. Lack of stop-loss discipline can cause small losses to grow.

Lesson 5: Protecting the Portfolio is Also a Strategy

In the uncertain periods of 2025, protective strategies in portfolio management should take precedence. The rallies in gold and silver demonstrated how portfolios could remain stable in such situations. Investors should pay attention not only to growth but also to balance and protection elements.

Finally, the lessons from 2025 reminded investors of the importance of accurately assessing their risk capacity, not only in the pursuit of profit.

```Benzer Haberler

.png)

Yakında Tüm Platformlarda

Sizlere kesintisiz haber ve analizi en hızlı şekilde ulaştırmak için. Yakında tüm platformlarda...

.png)