Striking Developments at the Market Opening in 2025

What You Need to Know Before the Market Opens

As we approach 2025, a volatile period is being experienced in the markets. When examining the US stock markets, it is noteworthy that the S&P 500 index has reached record levels at 6,930 points, but has seen limited losses due to profit-taking. The Dow Jones and Nasdaq, on the other hand, recorded a decline of about 0.4-0.5%. For the year, the Dow Jones has a return of 14%, while the Nasdaq has over 20%.

Investor's Favorite: Fed Meeting Minutes

The minutes of the Fed's December meeting are the main agenda item for the markets. The Fed has made a total of 75 basis points in interest rate cuts in the last three meetings, bringing the policy rate down to the 3.50-3.75% range. However, it is noteworthy that divisions of opinion continue during this process. President Donald Trump has posed threats to sue Jerome Powell for "gross negligence," creating a factor that increases uncertainty in the markets.

Corporate News and Developments in Commodity Markets

The $5 billion stock sale agreement between Intel and Nvidia has drawn attention, while Boeing's high-value defense contract with Israel has also piqued investors' interest. In the commodity market, profit realizations after record levels in precious metals have led to sharp retreats in silver and platinum prices. However, in long-term assessments, geopolitical risks, central bank purchases, and a weakening dollar suggest that the main trend of precious metals has not deteriorated.

Global Market Insights

Oil prices are experiencing fluctuations due to the Russia-Ukraine tension and risks in the Middle East. The evolution of geopolitical strategies continues to affect market direction.

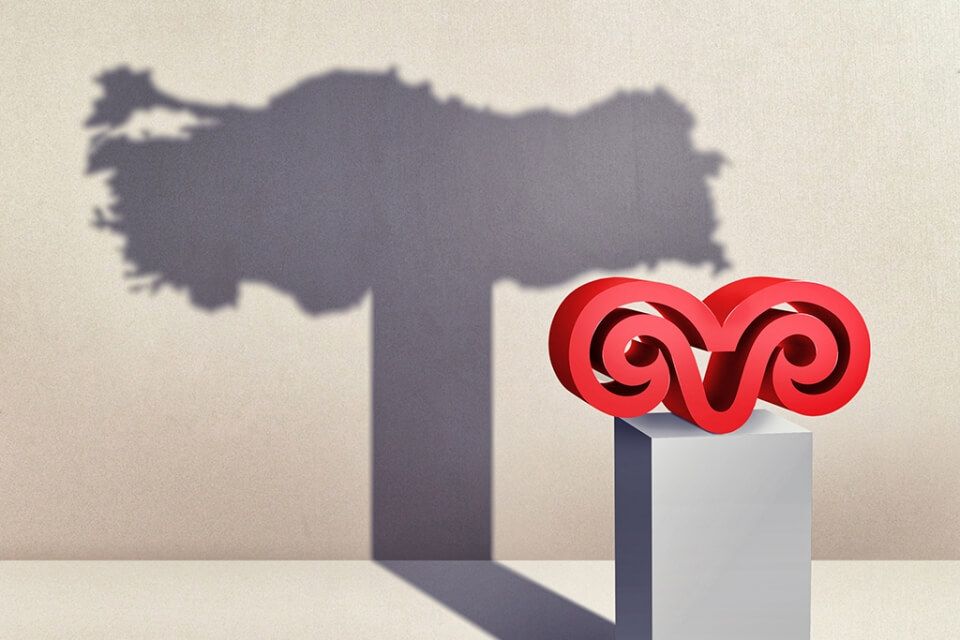

On the Borsa Istanbul front, a cautious outlook prevails. The BIST 100 index closed the day with a loss of over 1%, having declined to the 11,150 level. Banking stocks remained more resilient during the day, while there was significant selling pressure on industrial stocks.

Finally, on the currency front, the upward movement of the dollar continues. The Dollar/TL is attempting to settle above the 42.90 level. Despite rising costs, the TL's separation from weaker currencies is viewed as a noteworthy development in the markets.

```Benzer Haberler

.png)

Yakında Tüm Platformlarda

Sizlere kesintisiz haber ve analizi en hızlı şekilde ulaştırmak için. Yakında tüm platformlarda...

.png)